are political contributions tax deductible for corporations

Regardless of whether a political contribution is made in the form of money or an in-kind donation it is not tax-deductible. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to receive tax-deductible donations.

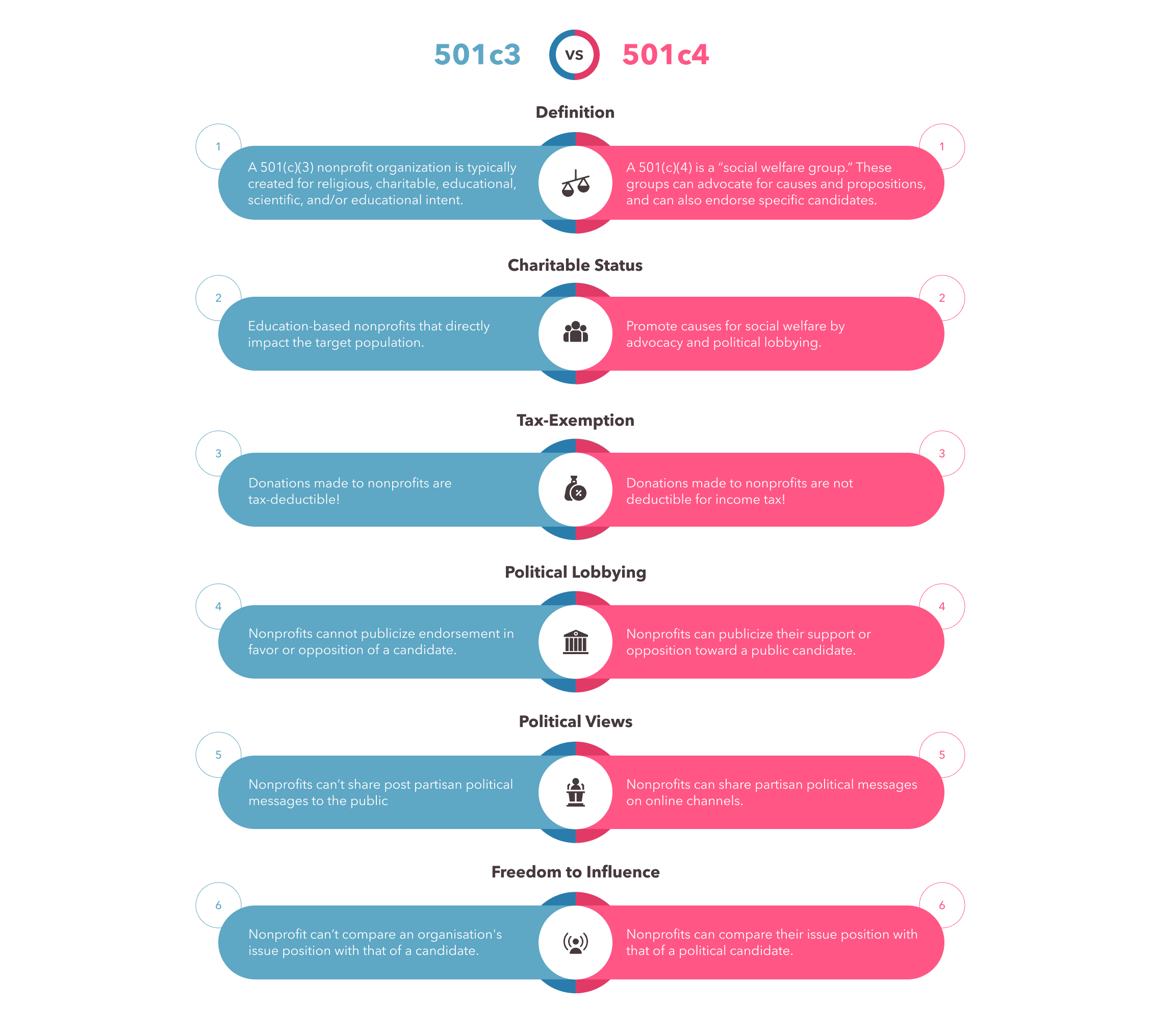

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income.

. Donations utilized before or after the campaign period are subject to donors tax and not deductible as political contribution on the part of the donor. Completing your tax return. Connect With A Self-Employment Tax Expert To Help You File Your Taxes Or Do Them For You.

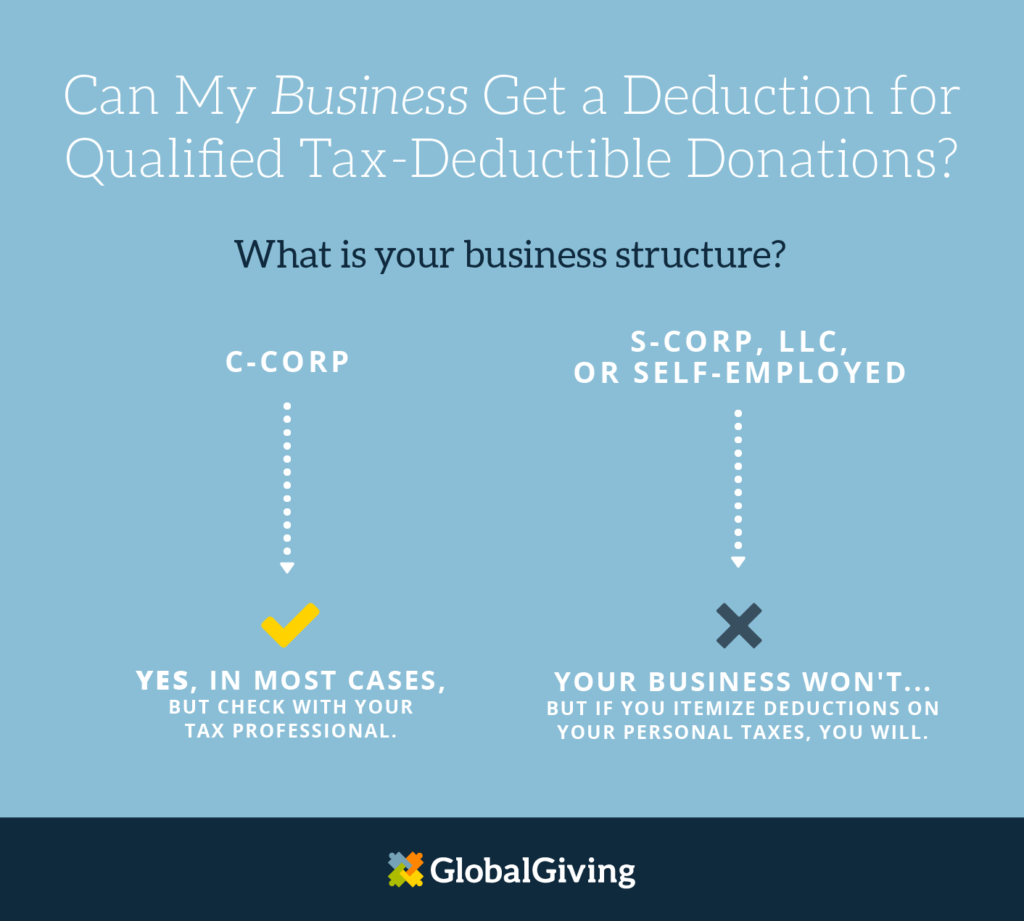

Use the chart for line 41000 of the Federal Worksheet to calculate that amount. Qualified contributions are not subject to this limitation. Businesses likewise cannot claim a deduction for political contributions whether theyre pass-through entities or file a corporate return.

The answer to the question Are political donations tax-deductible is simply No May the entity be an individual a business or a corporation all kinds of political donations come under those opted purely by choice and hence can not be recognized as tax-deductible as per IRS rules and regulations. Contributions made to federal or state parties registered associations or candidates in elections are tax deductible. Payment submitted to a political party or those made for lobbying support will not be deductible for C.

Political contributions arent tax deductible. Donations to this entity are not tax deductible though. A Super PAC or a Hybrid PAC requires contributions from a certain group.

This applies to a wide range of things associated with politics including political candidates and parties political action committees. Whats more not every communication between an organization and an official is considered lobbying. The simple answer to whether or not political donations are tax deductible is no However there are still ways to donate and plenty of people have been taking advantage of.

It is necessary to receive an official contribution receipt in order to claim your political contribution. Political contributions are defined as those made to political campaigns. No political contributions are not tax-deductible.

This doesnt just mean that donations made to candidates and campaigns are excluded from being tax deductible. But contributions to candidates and parties arent deductible no matter who makes them. Each year you can claim up to 650 in tax-free income.

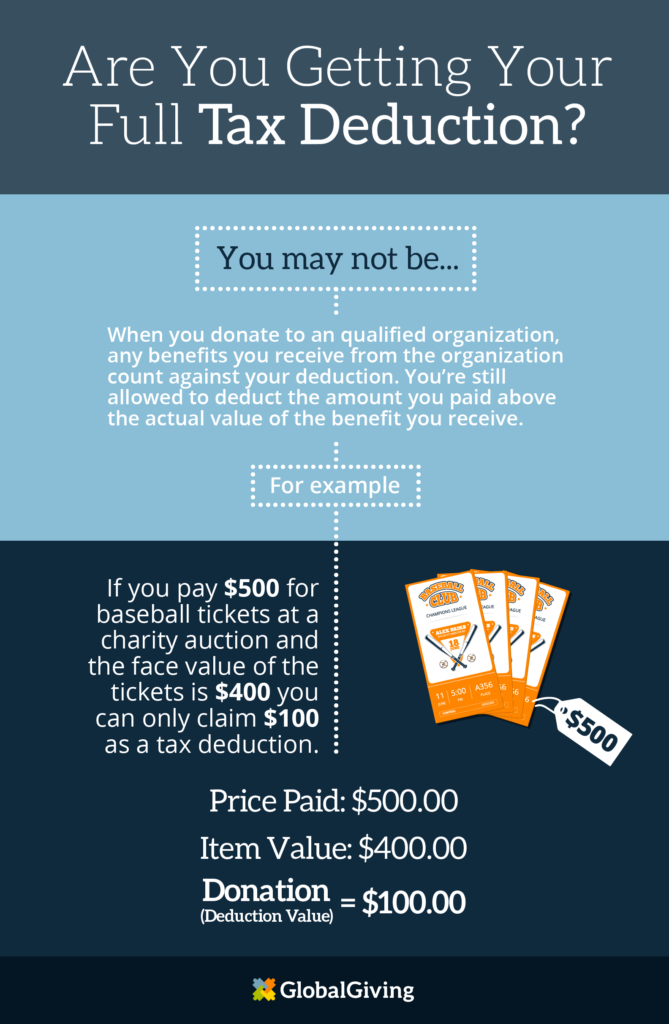

Many taxpayers oversimplify the rules surrounding the charitable contribution deduction. For amounts over 750 33 will be charged. In the first 400 that you contribute 75 percent gets refunded.

1 attorney answer Posted on Jul 26 2009 Usually theyre not deductible. These organizations do not have contribution limits and donors do not need to be disclosed publicly. Brajcich JD LLM CPA.

Generally donations to these entities are used for advocacy but not direct electoral purposes where youre asking someone to support or oppose an issue. Claim on line 40900 of the return your total federal political contributions for 2021. However the world of taxes can be complicated.

Therefore it is wise to partner with a financial advisor or tax professional. 1 found this answer helpful. While political contributions arent tax-deductible many citizens still donate money time and effort to political campaigns.

However in-kind donations of goods to qualified charities can be deductible in the same way as cash donations. Claim on line 41000 of the return the credit you are entitled to. The laws and issuances are harmonized for a consistent interpretation for campaign donations.

In each 400 contribution between 400 and 750 50 percent gets refunded. Although political contributions are not tax-deductible there is always a limit to the amount that can be contributed to a political campaign. Contributions or expenditures made by a taxpayer engaged in a trade or business designed to encourage the public to register and vote in Federal state and local elections and to contribute to the campaign funds of the candidate or party of their choice are deductible by the taxpayer under section 162 a of the Internal.

These laws must be read with the changes made by the Corporation Code for campaign contributions. By Andrew M. Zee March 2 2022 Uncategorized No Comments The federal government allows various deductions that can help reduce your taxes but this does not include your political contributions to the campaigns of any organization or individual.

Individuals can contribute up to 2800 per election to the campaign committee up to 5000 per year for PAC and up to 10000 per year for local or district party committees. A tax deduction allows a person to reduce their income as a result of certain expenses. They will be able to help you navigate what is and is not tax-deductible and therefore help you put your.

Couples who make contributions of 6000 or more over 50000 will be entitled to a credit. You cant make a tax-deductible donation to a candidate or campaign but you can make a deductible contribution to a 501 c 3 organization that can lobby candidates about issues you care about. Political Contribution Tax Credit for Corporations Effective January 1 2017 this credit is eliminated for corporations.

With the 2020 elections behind us and tax-filing season now here you might be wondering whether or not you can deduct political contributions you made last yearThe short answer. Although political contributions are not tax-deductible other deductions can help both individuals and businesses save money on taxes. Contributions that exceed that amount can carry over to the next tax year.

A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Political Contributions and Expenses Paid by Businesses. Most are aware that contributions to public charities were previously deductible up to 50 of adjusted gross income AGI and that for tax years 2018 through 2025 the deduction cannot exceed 60 of AGI.

Political contributions deductible status is a myth. Are political and lobbying expenses tax deductible for a C corporation. Can Corporations Give To Pacs.

However if your total federal political contributions from line 40900 were 1275 or more enter 650 on line 41000. Some contributions can be made to the educational arm of a political organization when those arms are qualified under IRS Code section 501 c 3 or 4. Ad Keep Every Dollar You Deserve When You File Business Taxes w TurboTax Self-Employed.

Are Political Contributions Tax Deductible For Partnerships Ictsd Org

Are Campaign Contributions Tax Deductible

Are Political Contributions Tax Deductible Smart Asset

Are Your Political Contributions Tax Deductible Taxact Blog

Federal And California Political Donation Limitations Seiler Llp

Sample Samples Fundraising Letters Emmamcintyrephotography Personal Fundraising Letter Temp Fundraising Letter Personal Fundraising Sample Fundraising Letters

Are Political Contributions Tax Deductible Anedot

Are Political Donations Tax Deductible Credit Karma Tax

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Are Political Contributions Tax Deductible Smart Asset

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Are Political Contributions Tax Deductible Anedot

Limits And Tax Treatment Of Political Contributions Spencer Law Firm

Understanding Tax Deductions For Charitable Donations

Are Political Contributions Tax Deductible Anedot

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos